Table of Content

At the moment, mortgage rates are pretty close to historic lows, with the popular 30-year fixed-rate mortgage averaging 3.09% last week, according to the latest data from Freddie Mac. Today, we’ll take a look at the impact of both home prices and mortgage rates on your decision to buy a piece of property, along with the relationship they share. At the end of the day, it comes down to your goals and priorities as a buyer.

Nuno Mano proved to be the best mortgage agent one could ever wish for, intelligent, professional and transparent. My husband and I both felt MonsterMortgage.ca was working on our behalf throughout the process. I have used Karen to secure my mortgage since 2013 .She has excellent customer service skills. For these reasons I have recommended workmates and friends to Karen for their mortgage services. But when it comes to the interest rate vs. home price, does one matter more than the other? This article will explain how the two work together and some things you should consider as you’re house hunting.

Is Now A Good Time To Buy A House? What To Know In 2022

This can be a good option if you feel ARM rates are likely to stay lower than fixed rates in the future. For example, the 30-year fixed rate has dramatically increased since the start of 2022, which has made the ARM rate a lower, more attractive option right now. The best type of mortgage loan depends on your personal financial profile, lifestyle goals and the type of property you want to own. Predictions indicate that home prices will continue to rise and new home construction will continue to lag behind, putting buyers in tight housing situations for the foreseeable future. Borrowers who comparison shop tend to get lower rates than borrowers who go with the first lender they find.

Those of us who were in real estate at the time know there were many other issues as well. Lending was horrible, there was record new building and tons of foreclosures, basically the opposite of what is happening now. I think most people in the industry would say increasing interest rates were not the main factor that caused the crash.

Mortgage Rates Are Still Very Low

It is also important for buyers to be conscientious of what their down payment will come up to. Having a down payment within their bracket can mean the difference between what neighborhood they end up in or if they can even afford to buy a house. It is arguable, however, that interest rates don’t matter too much. As long as a homeowner can consistently afford their payments, there should be no problem. According to the National Association of Realtors , experts have predicted that the economy will bounce back post-pandemic. Remember that volatility creates opportunity, but it also heightens risk, so it’s important that traders adhere closely to their risk management strategies and trading plan.

If interest rate cuts affect the stock market, this can usually be tracked through the S&P 500 and traders can make buying or selling decisions based on this. Around the time of Federal Open Market Committee announcements, there can be significant volatility on S&P 500 stocks, signaling the potential for short-term trading opportunities. When the economy is strong, interest rates tend to rise along with growth. Higher interest rates, however, translate into higher mortgage loan costs. For example, by paying upfront 1% of the total interest to be charged over the life of a loan, borrowers can typically unlock mortgage rates that are about 0.25% lower.

Interest Rate Vs. Home Price: Which Matters More?

Houses sold prior to completion are excluded from the statistics for the median number of months for sale. New residential sales estimates only include new single-family residential structures. About This Data New Residential Sales data provides statistics on the sales of new privately-owned single-family residential structures in the United States. However, record-low rates were largely dependent on accommodating, Covid-era policies from the Federal Reserve. And the more U.S. and world economies recover from their Covid slump, the higher interest rates are likely to go. Let’s look at a few examples to show how rates often buck conventional wisdom and move in unexpected ways.

$70,000 in 1982 would be worth $200,000 today after inflation is taken into consideration. The total interest paid into that loan would be $1,327,652.20 after 30 years! Remember that average mortgage rates are only a general benchmark. If you have good credit and strong personal finances, there’s a good chance you’ll get a lower rate than what you see in the news. Adjustable-rate mortgages traditionally offer lower introductory interest rates compared to a 30-year fixed-rate mortgage. However, those rates are subject to change after the initial fixed-rate period.

This only occurred in the early stages of the Global Financial Crisis and during the recovery. In the real estate industry, the gold standard is to put down a 20% down payment when you’re buying a home. That means if you’re buying a $300,000 house, you’ll make a down payment of $60,000. As house prices start to rise, your required down payment will go up as well. On the other hand, low house prices give buyers the ability to minimize their initial down payment.

Changes to bank rates can cause volatility, which means there’s often opportunity to trade around the changing prices of stocks. If interest rates are higher and stock prices are falling, this could present opportunity for traders who think the price will ultimately rise again over time. An ARM index is what lenders use as a benchmark interest rate to determine how adjustable-rate mortgages are priced. You can check rates online or call lenders to get their current average rates. You’ll also want to compare lender fees, as some lenders charge more than others to process your loan.

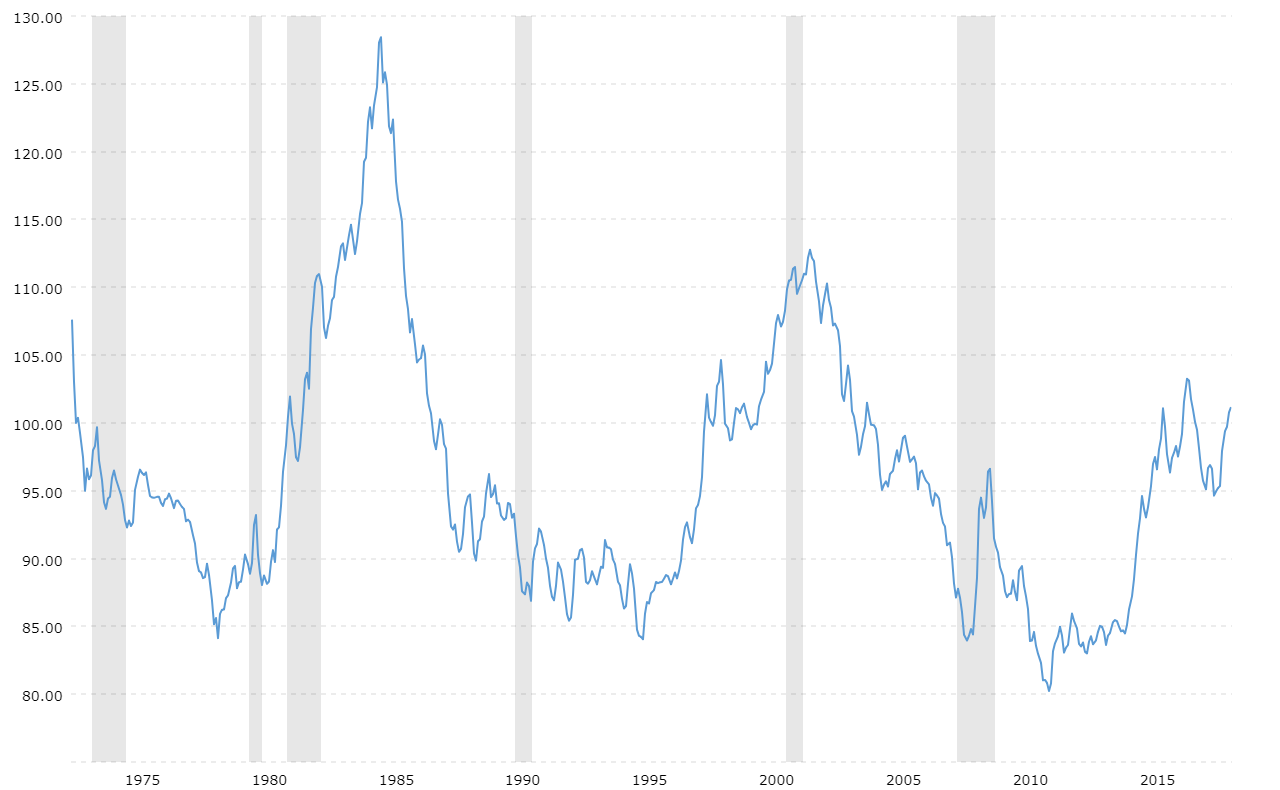

If you are stretched too close to the top end of your price point and rates go up, you might not be able to buy that dream home you want because you will no longer qualify for that sales price. Conversely, if rates drop, you might be able to afford a significant jump in price. It clearly shows that as interest rates decline, prices of real estate increase and sometimes increase very dramatically. I suppose we all know this occurs – it’s called an inverse relationship in economics but to see this so clearly – especially over 10 or 12 years is quite remarkable. COVID-19 caused interest rates to drop to historic lows, so people may be nervous at the news that mortgage rates are rising.

You can also see that this study says most other studies have concluded there is very little to no correlation between interest rate changes and housing prices. I think the more telling sign is from the 1980s and 1970s where interest rates rose to astronomical highs! It is important to know that the first graph is not what mortgage rates were. Mortgage rates that people get on their houses are not directly tied to the prime rate. For the week of Oct. 9, 1981, mortgage rates averaged 18.63%, the highest weekly rate on record, and almost five times the 2019 annual rate. A lot of the correlation during the period might just be the move to stable price controls since Paul Volker considering the entire period has roughly seen decreasing mortgage rates.

By contrast, countries reliant on importing energy have seen weaker currencies. This includes the Japanese yen, Swedish krona, and the British pound. In the case of China, a weaker currency is the impact of a slow economic growth outlook due to its strict zero-COVID-19 strategy and low interest rates. Now, as inflation appears to be easing and lower rate hikes look to be in the cards, the U.S. dollar is cooling. Still, relative to many of the other major global currencies it remains strong.

No comments:

Post a Comment