Table Of Content

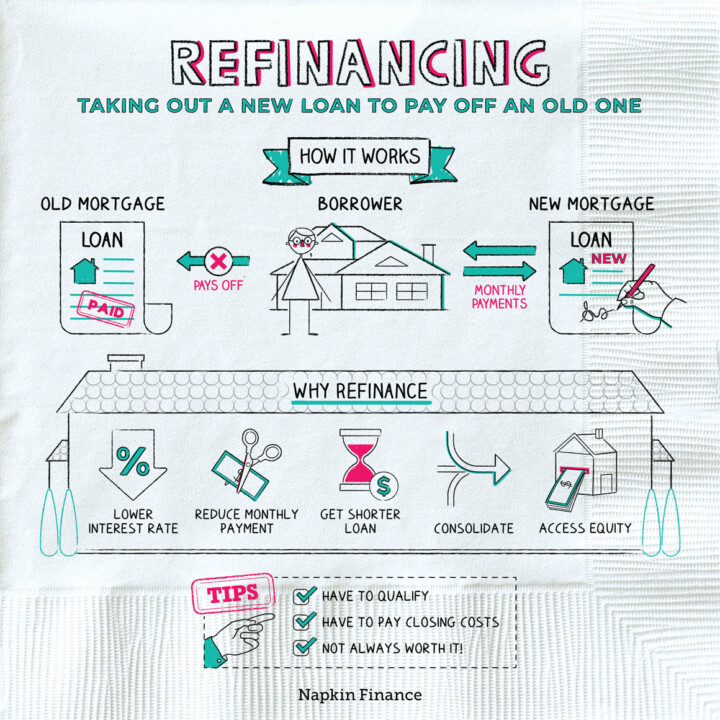

A refinance could also allow you to remove another person from or add them to the mortgage. Let’s go over some of the most common types of mortgage refinance options pursued by homeowners, their key features and how to decide which one is the ideal choice for you. Refinancing fees and closing costs are similar to the percentages you’d pay for a purchase mortgage. Typically, they cost 3% to 6% of your outstanding principal balance. "Of all the data, I think that the inflation, specifically the [Consumer Price Index] out May 15, will have the biggest impact," Hale told Newsweek. The Federal Reserve raised interest rates starting in March 2022 to its current two-decade high of 5.25 to 5.5 percent, a move geared to fight soaring inflation.

Explore the connection between rate and monthly payment.

I thought my credit score, income, and other financial bona fides were sufficient to qualify me to get a mortgage, but I didn't know for sure. Learning that yes, I was likely to be approved to borrow more money than I've ever borrowed before helped me start looking with more of a spring in my step. Finally, having pre-approval ahead of house hunting gives you confidence. My own history with homeownership is not good, and I swore for years that I'd never buy a house again. Ultimately, I changed my mind, and I am now eating crow as I wait on a mortgage closing.

How much equity do you need to refinance?

The major difference between a refinance and a loan modification is that refinancing gives you a new mortgage. Modification changes your current terms to add missed payments back into your balance with the goal of helping you stay in your home. A modification should only be considered if you can’t qualify for a refinance and need long-term payment relief. Modification typically has a major negative impact on your credit score. If you’re refinancing to take cash out, for example, then the value of your home determines how much money you can get.

When to refinance a mortgage

Refinancing is an opportunity to change the terms of your mortgage. For example, if you currently have a 30-year loan, consider whether you want a new 30-year loan or possibly a 15- or 20-year one instead. It’s possible to negotiate certain lender fees—such as getting them to waive the underwriting and processing fees.

Jumbo loans

Since all lenders must follow the same rules to ensure the accuracy of the APR, borrowers can use the APR as a good basis for comparing the costs of similar credit transactions. Founded in 2000, Guaranteed Rate is a mortgage lender specializing in a digital mortgage experience. Consumers can check out refinance rates online, find information about Guaranteed Rate’s loan products, or read articles about mortgage lending and an easy online application process. Guaranteed Rate offers seven different refinance programs, including a wide variety of fixer-upper refinance programs. Refinancing from an adjustable-rate mortgage (ARM) is a common practice, especially around the point when the rates on an ARM are about to adjust following the introductory period. If you have an ARM,believe interest rates will go down and you want predictable monthly payments, refinancing to a 30-year fixed may make sense.

And though the monthly payments are higher on 15-year refinance loans, you will pay less interest over the life of the loan compared to a 30-year mortgage. Lenders typically see refinances as riskier than purchase mortgages. Banks, credit unions and many online lenders offer mortgage refinancing options. Sometimes your current financial provider will offer a better deal in order to keep your business while other times, a competitor will offer a better rate to gain your business. Find out the rates each lender is offering as well as the annual percentage rate (APR)—the all-in cost of a loan, which includes fees. When the slider shifts from red to orange, it means that the interest savings total more than the closing costs during that period — but your monthly payments will be higher.

Can you reduce your monthly payment without refinancing?

More about that below, but if your closing costs will be $4,800, for instance, and your monthly savings are $200, then you’ll break even in 24 months or two years. If you plan to be in the house well past two years, a refi could make sense. If you’re looking to lower your monthly payments, shrink your interest rate, shorten the term of your loan or change your loan type, a refinance could be the right move for you. Reducing the interest rate is by far the most popular reason to refinance a mortgage. If you can qualify for a lower rate than your existing mortgage interest rate, refinancing can reduce your monthly mortgage payments or potentially save thousands in interest over the life of your loan.

What your loan term means

Let us estimate your rate and help you reach your financial goals. When you’re shopping for a home, you’ll be making many decisions, from the price of the house you can afford to the neighborhood you want to live in. Another important decision is the type and length of your mortgage.

Finalize your loan terms

Mortgage payment schedules often range from 10 to 30 years, with 30-year terms being the most common. There are several types of mortgages, each offering unique characteristics and benefits. The right type of home loan depends on your credit score, down payment, location and more. A cash-out refinance is a way to refinance your mortgage with a larger home loan so you can receive the difference between what you still owe and the rest of the loan balance in cash. This type of refinance mortgage lets you access your home’s equity, up to a certain limit, for anything you need.

This usually happens when you shorten the loan term, say from 30 years to 15 years. If you've gained equity of at least 20%, whether by appreciation or by simply paying your mortgage, you may be able to refinance to cancel mortgage insurance and save money with each monthly payment. A mortgage refinance replaces your current home loan with a new one. Often, people refinance to reduce their interest rate, cut their monthly payments or tap into their home’s equity. Others refinance a home to pay off the loan faster, get rid of FHA mortgage insurance or switch from an adjustable-rate to a fixed-rate loan.

15-year refinance rates: Pros, cons and current lenders offers - CNN Underscored

15-year refinance rates: Pros, cons and current lenders offers.

Posted: Wed, 01 May 2024 13:28:35 GMT [source]

An FHA Streamline refinance can be a great option for homeowners with Federal Housing Administration (FHA) loans who are looking to lower their monthly payments and avoid a repeat of the FHA appraisal process. If you currently have a conventional loan, you won’t be able to switch to an FHA mortgage with this type of refinance. Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site.

Or, the slider's color might change from red to green and then to orange in this scenario, indicating that you'll save money for a while — before the total payments pile up. Mortgage lenders typically require a home appraisal (similar to the one done when you bought your house) to determine its current market value. A professional appraiser will assess your home based on criteria and comparisons to the value of similar homes recently sold in your neighborhood. Gather recent pay stubs, federal tax returns, bank/brokerage statements and anything else your mortgage lender requests.

Homeowners still have time to lower their monthly mortgage payments by refinancing, as mortgage rates are still relatively low. Use Zillow's refinance calculator to determine if refinancing may be worth it. Enter the details of your existing and future loans to estimate your potential refinance savings. Refinancing can be one of the most significant financial decisions you make. If you’re planning to remain in your home for years to come, extending your loan term to lower monthly payments — or using the equity you’ve built to finance home improvements — can make sound financial sense. You can even refinance multiple times, as long as you abide by your lender’s waiting period (if they have one).

No comments:

Post a Comment